Brand building in the cannabis industry

The North American cannabis market – while still in its early days – has changed a lot in the past few years. Canada legalised recreational use of the drug in 2018 and to date 16 US states have fully legalised marijuana use (36 allow it for medical purposes). The shifting legal and regulatory framework has had an impact on businesses’ trademark strategies in both countries, with brand owners having to act quickly and think ahead to ensure that their rights are protected.

Canada

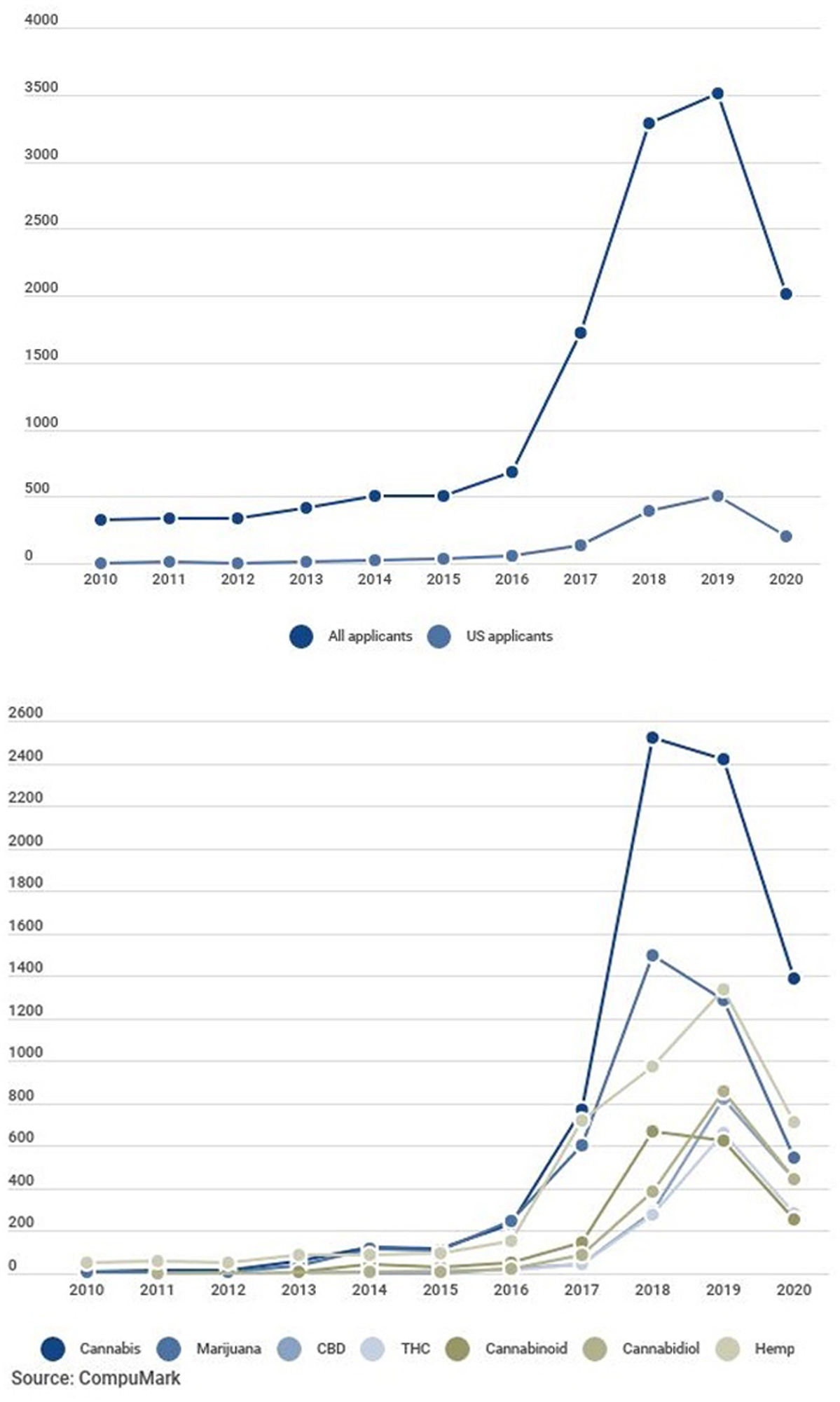

The Cannabis Act was implemented in Canada in October 2018. Marijuana businesses jumped at the opportunity to be able to protect their brands, resulting in a surge of cannabis-related trademark applications in 2018 and 2019 (see Figure 1). Graham Hood, partner at Smart & Biggar, described it as a “green rush”, but activity has subsided somewhat since.

Figure 1: "Cannabis" and related trademark applications filed in Canada

There are a number of reasons for this drop in volume, says Hood. It could be that companies have already secured protection for their core brands or it could have something to do with the uptick in M&A, which has seen major players snap up smaller entities. The pandemic has also played a role, forcing companies to rethink their product offerings and how to bring these to market.

The downward trend in application levels also has to do with a shift in business strategy. “Going into 2020, even before the covid-19 pandemic, I saw my cannabis clients scale back on legal and operational spend in order to stay profitable,” reports Gowling partner Natalie Rizkalla-Kamel. “Rather than increasing the number of brands, I have seen cannabis companies focus more on their partnerships and the quality of their products associated with their brands.”

Post-legalisation trademarks were a novelty, but businesses’ brand building and trademark strategies have since matured. “In 2018 and 2019, companies were rushing to the trademark office to file marks, some of which were descriptive of the cannabis goods or that were commonly used in the industry and thus did not distinguish them from other players in the market,” says Rizkalla-Kamel. Now, brand owners are savvier and are emphasising marks that are unique and distinctive.

Another interesting trend on Rizkalla-Kamel’s radar is the increase in trademark applications for particular cannabis strains. The USPTO does not allow such terms to be registered marks. However, the Canada Intellectual Property Office (CIPO) is not yet familiar with all cannabis strains and is therefore not (yet) objecting to the registration of these marks.

Canadian companies’ brand strategies are largely focused on their home market despite some foreign countries becoming increasingly cannabis friendly. It is, of course, impossible to register federal trademarks in the massive market that sits south of the border, but that is not to say that Canadian applicants do not try. Figure 7 shows the number of cannabis trademark applications lodged by US and Canadian companies each year. Filings crept up in 2018 and 2019 but fell in 2020 in line with the industry-wide drop in activity. The top filer of cannabis-related trademarks at the USPTO is Canadian company Aphria Inc, while another three Canadian businesses feature among the top 20 (see Table 1).

Table 1: Top filers of cannabis-related trademarks

| Entity | Number of applications |

|---|---|

| United States | |

| Aphria Inc (Canada) | 100 |

| Blue, John D | 63 |

| Medical Marijuana Inc | 52 |

| OG DNA Genetics Inc | 49 |

| Canopy Growth Corporation (Canada) | 45 |

| CV Sciences, Inc | 37 |

| Tweed, Inc. (Canada) | 36 |

| HDDC Holdings LLC | 33 |

| Balanced Health Botanicals LLC | 33 |

| Holi Hemp LLC | 31 |

| Naz Holdings LLC | 29 |

| Harvest IP Holdings LLC | 29 |

| OG Enterprises Branding Inc | 28 |

| Central Coast Agriculture Inc | 28 |

| US Tobacco De Mexico | 27 |

| Fresh Hemp Foods Ltd (Canada) | 26 |

| Hempvana LLC | 25 |

| Woodstock Ventures LC | 24 |

| Mead Johnson & Company LLC | 24 |

| Farmer & Chemist LLC | 24 |

| Canada | |

| Brandster Branding Ltd | 420 |

| Tweed Inc | 200 |

| Aphria Inc | 137 |

| 1194360 BC Ltd | 90 |

| Aurora Cannabis Enterprises Inc | 87 |

| Spectrum Cannabis Canada Ltd | 73 |

| The Toronto-Dominion Bank | 66 |

| Endeavor Systems Limited | 63 |

| Yango Limited | 62 |

| Trichome Cannabrands Inc | 56 |

| Shake Technologies Limited | 55 |

| Hexo Operations Inc | 54 |

| Apricot Technologies Limited | 51 |

| The Supreme Cannabis Company Inc | 50 |

| Canntrust Inc | 45 |

| Aurora Marijuana Inc | 44 |

| Canopy Growth Corporation | 42 |

| Truss Limited Partnership | 40 |

| TS Brandco Inc | 39 |

| Dutch Passion Holding BV | 37 |

Source: CompuMark

Drilling down into the cannabis trademark landscape in 2018 uncovered a heavy focus on goods in Classes 34 (smokers’ articles) and 5 (medicines/pharmaceuticals), as well as Nice classes relating to food and drink products. Since then businesses have taken advantage of legalisation at state level to expand product lines and seek protection in adjacent areas.

Applications are still concentrated on Classes 5 and 34, but there has been significant growth in Class 35 (retail services) and Class 3, which covers essential oils (see Table 2). Services more broadly have increased in importance, including Classes 39 (distribution services), 41 (education), 42 (research and consulting) and 44 (medical services).

Table 2: Nice Classes of cannabis-related trademarks

| Class | Number of applications | |

|---|---|---|

| State level | ||

| 5 | Medical products | 2,073 |

| 31 | Agricultural products | 1,642 |

| 34 | Smokers' articles | 1,621 |

| 35 | Retail services | 1,262 |

| 44 | Medical services | 760 |

| 30 | Food of plant origin | 464 |

| 42 | Research; consulting | 235 |

| 29 | Edible oils | 221 |

| 3 | Essential oils; cosmetics | 205 |

| 41 | Education | 188 |

| 39 | Distribution services | 141 |

| Canada | ||

| 5 | Medical products | 5,107 |

| 34 | Smokers' articles | 5,030 |

| 35 | Retail services | 4,430 |

| 30 | Food of plant origin | 3,906 |

| 29 | Edible oils | 3,625 |

| 31 | Agricultural products | 3,436 |

| 3 | Essential oils; cosmetics | 3,071 |

| 44 | Medical services | 2,702 |

| 41 | Education | 2,399 |

| 42 | Research; consulting | 2,080 |

| 39 | Distribution services | 1,356 |

Source: CompuMark

United States

Cannabis is illegal in the United States under the Controlled Substances Act, meaning that related trademarks cannot be registered. According to Monica Riva Talley, director at Sterne, Kessler, Goldstein & Fox, “the USPTO has been very diligent about monitoring and refusing applications for goods that fall under the act”. Despite the no-go policy, applicants have continued to file for protection at the federal level, as seen in Figure 2.

Figure 2: "Cannabis" and related trademarks filed at the USPTO

As the momentum for legalisation has picked up in the United States, there has also been movement towards federal filings and registrations for products and services related to the cannabis trade. The USPTO has allowed registrations for marks used to publish information about the benefits of these offerings, among other things. “Registration for ancillary goods and services may provide some modicum of protection for entities who also offer actual cannabis products or distribution services under the same mark,” explains Talley.

This is a savvy tactic as it lays the groundwork for those that want to jump on federal protection when (and if) it becomes available. Trademark attorney and founder of Gerben Law Firm, Josh Gerben, points to Seth Rogan as an example. The Canadian actor has filed an application for his cannabis brand Houseplant in a wide range of goods, including bags, visors and toques, pyjamas, electronic cigarettes and even tuxedos and cocktail dresses.

The strategy of focusing on applications that have a higher chance of registration has proven popular. Figure 8 shows the application numbers for related cannabis marks. The number of applications including terms such as CBD and THC jumped in 2018 and 2019, while applications for hemp exploded during the same period. On 20 December 2018 – the day hemp was officially legalised in the United States – 1,000 cannabis-related applications were filed at the USPTO.

There is another option though for those keen to establish their brands in the United States: trademark registration in states where cannabis is legal. State-level trademark data is not as accessible as USPTO data, but CompuMark director of government and content strategy Robert Reading has dived into the numbers to look at applications being filed with cannabis or marijuana in the specification. The results reveal a steady growth across most states, with a spike in activity in California in 2018 (see Figure 3).

Figure 3: Trademark applications at state registers and year of legalisation

As legalisation creeps closer in the United States some attorneys hypothesise that brands will try to get in early for protection. “Given the arguable momentum behind legalising cannabis on a federal level, we do expect some entities will undertake proactive anticipatory filing programs, essentially betting on federal legalisation prior to receiving final USPTO refusal on these grounds,” says Talley.

Looking to the future

Brand owners in the cannabis space have their work cut out for them. While we have touched on the high-level trends in the field, there are other things going on behind the scenes that complicate the picture:

- CIPO’s examination times – the industry is fast-moving and the fact that it currently takes well over two years from filing to examination means that brands need to plan in advance to really cover their bases and anticipate business needs. Trademark decisions will be important and there may be difficult calls to make.

- Canada’s advertising/labelling regulations – labelling, packaging and marketing for cannabis products is seriously limited, making it difficult for businesses to build brands that resonate with consumers. There is hope that rules will be relaxed; otherwise, Canadian businesses are at a disadvantage given that those south of the border are afforded greater freedoms in promoting their brands.

- Preparing for international expansion – brand owners need to know the status of the market that they are entering, as well as any street brands that may already exist, in addition to understanding how their brand will be perceived among consumers. It is a lot of work and some of these are unusual considerations that businesses in the industry have to understand.

Cannabis is one of the most difficult industries for brand owners to operate and grow in given the complexity of the market. Businesses must be flexible to capitalise on legal changes as and when they happen but must also operate with foresight to secure protection for the new products and opportunities that will undoubtedly arise in future. Ultimately, brand owners need a strong business partner in their trademark attorney.

(A version of this article first appeared on the WTR platform on 31 April 2021.)