A new normal: trademark community on life during and after the coronavirus pandemic – exclusive survey results

- Survey looks at work of trademark practitioners during covid-19 outbreak

- Most corporate counsel concerned by budget cuts and rise in counterfeits

- Over half of law firm practitioners report fall in brand protection work

New research from WTR reveals the brand protection challenges being faced by trademark professionals during the ongoing covid-19 crisis. The findings reveal an industry upended by the pandemic, with professionals facing significant salary cuts, increased infringement and the spectre of budgets being slashed.

Over the past two weeks, WTR has sought insights from the trademark community on how their work has been affected by the coronavirus pandemic. The responses, received from more than 50 respondents, provide a snapshot on both the current status quo and expectations for the future. The short survey garnered insights from law firm practitioners (53.5% of respondents) and corporate counsel (46.5%). Over a quarter of respondents (28%) were located in the United States, with respondents also located in countries including the Netherlands, India, Turkey, the United Arab Emirates, the United Kingdom, Switzerland, Cameroon, Russia, Italy, Spain, France, Finland, Albania, Ukraine, Colombia, Ecuador, El Salvador, Australia and New Zealand.

In-house insights

The vast majority of corporate counsel confirm that the covid-19 outbreak has had a direct impact on their trademark department. In all, 16% report that it has had a “significant” impact on trademark work, while 64% say that it has had a minor impact. Only 20% of corporate respondents state that covid-19 has had no impact. In terms of workload, 40% of in-house respondents observe that the coronavirus outbreak has led to an increased workload, with 32% saying that they now have a decreased workload (see graph below).

Has the covid-19 outbreak changed your trademark practice/brand protection workload?

Turning to the brand protection activities that have seen an increase in workload, online policing (especially on online marketplaces and social media platforms) experienced the biggest rise, with 44% of corporate respondents claiming an increased workload in this area. The sending of cease and desist letters is also on the rise in 26% of corporate departments.

When it comes to the risks faced because of the coronavirus outbreak, corporate counsel are most concerned by potential budget reductions, with 80% of respondents voicing that worry (see table below). Also of significant concern is a potential rise in counterfeiting and online trademark infringement, with 40% also fearing a loss of productivity due to the lockdown procedures introduced by national governments. Positively, perhaps, only 4% of respondents are concerned that law firms will not be able to sustain service levels.

Over the next 12 months, which of these actual or potential risks resulting from the covid-19 outbreak are you concerned about for your company's trademark practice?

Budget reductions | 80% |

|---|---|

Rise in counterfeiting | 56% |

Rise in online trademark infringement | 52% |

Loss of employee hours and/or productivity due to quarantine/lockdown | 40% |

Headcount reductions | 40% |

Disruption from closure of IP offices | 28% |

Disruption from closure of courts | 20% |

Challenge of business interruption due to incapacity of key personnel | 16% |

Cyberattacks as a result of increased remote working | 12% |

Inability of law firms to sustain service levels | 4% |

When asked to name the biggest challenge that their trademark department has faced due to the coronavirus outbreak, the responses were varied, with only some of them directly covid-related. For example, one brand owner is tackling fake protective equipment that contains branded elements. “There has been a wave of counterfeit branded face masks as a direct result of the coronavirus which pose greater health and safety risks to consumers and potential for brand dilution,” they explained. “Luckily online service providers have launched task forces to deal with these specific issues.”

Other responses are a reminder of the financial challenges being faced by thousands of businesses across the globe, and how that directly affects many trademark professionals. One in-house respondent, for instance, is currently tasked with protecting a corporate brand while they and colleagues contend with pay cuts. “Drastic internal company decisions [have] cut employees' salaries by 30% for three months at the very least,” the respondent told us. “So we have to continue to work 100% for the reduced salary and, in case of disagreement, employees are offered to terminate their employment contracts.”

Law firm perspective

Of course, law firm practitioners are also experiencing the effects of the covid-19 outbreak, often in similar ways. When asked if the pandemic has affected their firm’s trademark practice, nearly 23% say that it has been “significantly” affected, with a further 68% saying that it has “somewhat” (see table below).

Has the covid-19 outbreak affected your firm's trademark practice?

Interestingly, that impact – for many private practitioners at least – could be due to clients currently outsourcing a lower amount of brand protection work. Over 50% of law firm respondents report a decrease in client demands during the pandemic so far, with just 20% reporting an increase (see table below). This is particularly interesting in relation to the in-house data (referred to above), which suggests that corporate workloads have increased since the covid-19 outbreak – clearly more work is being placed on the shoulders of corporate teams.

Have clients had more brand/trademark protection demands during the covid-19 outbreak?

In terms of the type of work that is decreasing, it seems that prosecution and litigation have taken the biggest hit – with over 40% of law firm respondents reporting a fall in such work (and 17% of respondents claiming all trademark litigation work has “ceased”). This is perhaps unsurprising, especially with many IP offices and courts currently closed or working remotely.

How has the covid-19 outbreak changed the workload of these trademark practice functions?

Ceased | Decreased | About the same | Increased | N/A | |

|---|---|---|---|---|---|

Trademark filing | 5.71% | 40% | 25.71% | 8.57% | 20% |

Trademark litigation | 17.14% | 42.86% | 25.71% | 8.57% | 5.71% |

Brand enforcement/cease and desists | 17.14% | 34.29% | 28.57% | 17.14% | 2.86% |

Brand monetisation (including licensing) | 20.59% | 23.53% | 20.59% | 5.88% | 29.41% |

Trademark watching/monitoring | 5.71% | 25.71% | 37.14% | 8.57% | 22.86% |

Domain name management/protection | 8.82% | 14.71% | 47.06% | 8.82% | 20.59% |

Online marketplace/social media policing | 5.88% | 20.59% | 44.12% | 20.59% | 8.82% |

The fall in workload is also a worry for law firm practitioners looking forward. When asked what they are most concerned about over the next 12 months, 68% of respondents worry that clients will be less likely to launch or develop brands, with 65% concerned by a possible fall in client spend for the rest of the year (see table below).

Indeed, when asked about the biggest challenge that they have faced, most law firm professionals were focused on the financial issues that covid-19 has raised. “There has been a reduction in our cash flow due to client churn and temporary suspension of projects,” said one private practitioner. “We have cancelled subscriptions to tools and services that allow us to deliver services in a scalable manner to protect our employees’ livelihoods.”

Another significant challenge for law firm counsel has been adapting to life in lockdown, with Skype and Zoom described as “lifesavers” by some practitioners. “I have been unable to interact with clients in person or have as much time with them during calls (because they are swamped), so I’ve been checking in more frequently by email,” said one, with another stating: “The key challenge has been keeping the plates spinning – it has required me and other professionals to take greater day-to-day responsibility for administration without passing the cost on to clients.”

Over the next 12 months, which of these actual or potential risks resulting from the covid-19 outbreak are you concerned about for your firm's trademark practice?

Client decisions to postpone brand launches/development | 68.6% |

|---|---|

Fall in client spend until end of Q2 (possibly Q3 or Q4) | 65.7% |

Client reluctance to enforce marks | 60% |

Loss of employee hours and/or productivity due to quarantine | 48.6% |

Headcount reductions | 40% |

Contractual/client obligations unable to be fulfilled | 40% |

Disruption from closure of courts | 34.3% |

Disruption from closure of IP offices | 28.6% |

Challenge of business interruption due to incapacity of key personnel | 17.1% |

Cyberattacks as a result of increased remote working | 17.1% |

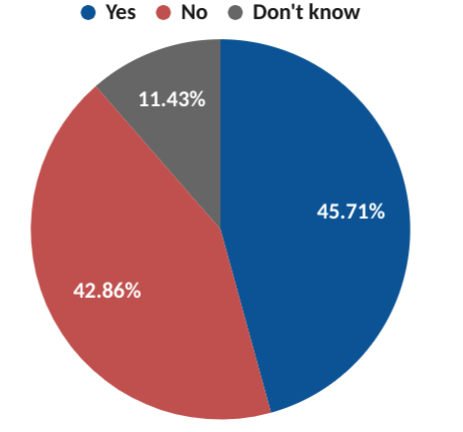

Despite the ongoing challenges, there are also opportunities to help – with nearly half of private practice respondents claiming that their firm has introduced initiatives to assist clients affected by the pandemic (see table below). When asked what measures have been introduced, the most cited are deferred payments, temporary discounts, reducing the scope of contractual engagements and the offering of pro bono work for clients with significant cash flow problems. In some cases, specialist attorneys from other practice areas are being made available to trademark clients for free. “As brands are struggling due to covid-19, some cannot meet their contractual obligations so what our company is doing is extending invoice payments, and offering free services for a few months to those most influenced by the current situation,” said one respondent.

Has your law firm introduced any initiatives/programmes to assist clients affected by the covid-19 outbreak?

Enforcement on the rise

Elsewhere, we asked both in-house and law firm practitioners about enforcement trends during the covid-19 crisis. When it comes to the level of fake goods on digital platforms, over half of all respondents claim that there has been more activity from counterfeiters over the past couple of months (see chart below). This finding echoes recent research that counterfeiters are “taking advantage of the covid-19 crisis”, which has led to a “stark rise in online counterfeits and fraudulent ads”. It also suggests that the production of fake goods may have returned to normal after WTR reported in February that most counterfeit factories in China had temporarily closed due to government-ordered lockdowns.

Have you noticed a change in the level of counterfeit goods activity online during the covid-19 outbreak?

It is not just counterfeit activity that is on the rise, either. Respondents also reported a stark rise in brand protection issues on online marketplaces and email phishing (see table below) – with one practitioner observing an increase in brand-related phone spamming as well. The rise is not necessarily a surprise; in March, the City of London Police reported a 400% increase in scams “as a result of coronavirus-related fraud”. The use of brand elements in this kind of criminal activity is common and poses a unique challenge for trademark practitioners.

Have you noticed a change in counterfeit/trademark/brand protection issues on the following platforms during the covid-19 outbreak?

Less infringement | About the same | More infringement | N/A | |

|---|---|---|---|---|

Social media platforms (eg, Facebook, Twitter) | 3.6% | 38.2% | 36.4% | 21.8% |

Messaging platforms (eg, WeChat, WhatsApp) | 3.6% | 25.5% | 20.0% | 50.9% |

Online marketplaces (eg, Alibaba, Amazon) | 1.8% | 29.1% | 40.0% | 29.0% |

Email phishing | 1.8% | 18.2% | 40.0% | 40.0% |

Website phishing/copycats | 1.8% | 30.9% | 27.3% | 40.0% |

Beyond the pandemic

While trademark practitioners are undoubtedly facing significant challenges in the current climate, respondents voiced hope that measures implemented now could become industry norms in the future. The number one change has been home working and video conferencing, with one practitioner certain that both of these will now be “the status quo instead of the exception in the industry”.

Further, many respondents expect “less conference and meeting travel” to occur for at least the next couple of years – partly for budgetary reasons, but also because practitioners are becoming used to using Zoom and other similar software.

From a broader perspective, some respondents suggest that the current (and future) economic effects caused by measures related to covid-19 could devastate the trademark industry. “Brands will have other priorities in place [after the coronavirus pandemic], and IP may take a backseat as they will be focusing on surviving in the market,” one practitioner stated.

What is clear from these findings is that the trademark community is adapting to a rapidly changing world – with the prospect of 'a new normal' in the months and years ahead.

In a follow-up article, we looked at how to prepare for the 'new normal' by speaking to a panel of trademark experts on the measures they've taken and how they expect trademark practice to change in the future.