Data Feeds

US Equities

Introduction

The US Equities data feed is a stream of security trades and quotes delivered to your trading algorithm during live execution. Live data feeds enable you to make real-time trades and update the value of the securities in your portfolio.

The US Equity Security Master data feed provides a live stream of corporate actions. The US Fundamentals data feed provides daily updates on company fundamentals. The US Equities Short Availability data feed provides the number of shares that are available for short sellers to borrow.

Sourcing

The US Equities data feed consolidates market data across all of the exchanges. Over-the-Counter (OTC) trades are excluded. The data feed is powered by the Securities Information Processor (SIP), so it has 100% market coverage. In contrast, free platforms that display data feeds like the Better Alternative Trading System (BATS) only have about 6-7% market coverage.

We provide live splits, dividends, and corporate actions for US companies. We deliver them to your algorithm before the trading day starts.

Universe Selection

The US Equities data feed enables you to create a dynamic universe of securities.

Coarse-Fine Universe

The live data for coarse and fine universe selection arrives at 7 AM Eastern Time (ET), so coarse and fine universe selection runs for live algorithms between 7 and 8 AM ET. This timing allows you to place trades before the market opens. Don't schedule anything for midnight because the universe selection data isn't ready yet.

AddUniverse(SelectCoarse, SelectFine);

self.AddUniverse(self.SelectCoarse, self.SelectFine)

ETF Constituent Universe

The US Equities data feed enables you to create a universe of securities to match the constituents of an ETF. For more information about ETF universes, see ETF Constituents Selection .

var spy = AddEquity("SPY").Symbol;

AddUniverse(Universe.ETF(spy, UniverseSettings, ETFConstituentsFilter)); spy = self.AddEquity("SPY").Symbol

self.AddUniverse(self.Universe.ETF(spy, self.UniverseSettings, self.ETFConstituentsFilter))

Bar Building

We aggregate ticks to build bars.

Discrepancies

In live trading, bars are built using the exchange timestamps with microsecond accuracy. This microsecond-by-microsecond processing of the ticks can mean that the individual bars between live trading and backtesting can have slightly different ticks. As a result, it's possible for a tick to be counted in different bars between backtesting and live trading, which can lead to bars having slightly different open, high, low, close, and volume values.

Opening and Closing Auctions

The opening and closing price of the day is set by very specific opening and closing auction ticks. When a stock like Apple is listed, it’s listed on Nasdaq. The open auction tick on Nasdaq is the price that’s used as the official open of the day. NYSE, BATS, and other exchanges also have opening auctions, but the only official opening price for Apple is the opening auction on the exchange where it was listed.

We set the opening and closing prices of the first and last bars of the day to the official auction prices. This process is used for second, minute, hour, and daily bars for the 9:30 AM and 4:30 PM Eastern Time (ET) prices. In contrast, other platforms might not be using the correct opening and closing prices.

The official auction prices are usually emitted 2-30 seconds after the market open and close. We do our best to use the official opening and closing prices in the bars we build, but the delay can be so large that there isn't enough time to update the opening and closing price of the bar before it's injected into your algorithms. For example, if you subscribe to second resolution data, we wait until the end of the second for the opening price but most second resolution data won’t get the official opening price. If you subscribe to minute resolution data, we wait until the end of the minute for the opening auction price. Most of the time, you’ll get the actual opening auction price with minute resolution data, but there are always exceptions. Nasdaq and NYSE can have delays in publishing the opening auction price, but we don’t have control over those issues and we have to emit the data on time so that you get the bar you are expecting.

Excluded Ticks

The bar-building process can exclude ticks. If a tick is excluded, its volume is aggregated in the bar but its price is not aggregated in the bar. Ticks are excluded if any of the following statements are true:

- The tick is suspicious.

- The tick is from the FINRA exchange and meets our price and volume thresholds.

- The trade has none of the following included

TradeConditionFlagsand at least one of the following excludedTradeConditionFlags: - The quote has a size of less than 100 shares.

- The quote has one of the following

QuoteConditionFlags: - The quote has none of the following

QuoteConditionFlags:

TradeConditionFlags | Status | Description |

|---|---|---|

Regular | Included | A trade made without stated conditions is deemed the regular way for settlement on the third business day following the transaction date. |

FormT | Included | Trading in extended hours enables investors to react quickly to events that typically occur outside regular market hours, such as earnings reports. However, liquidity may be constrained during such Form T trading, resulting in wide bid-ask spreads. |

Cash | Included | A transaction that requires delivery of securities and payment on the same day the trade takes place. |

ExtendedHours | Included | Identifies a trade that was executed outside of regular primary market hours and is reported as an extended hours trade. |

NextDay | Included | A transaction that requires the delivery of securities on the first business day following the trade date. |

OfficialClose | Included | Indicates the "official" closing value determined by a Market Center. This transaction report will contain the market center generated closing price. |

OfficialOpen | Included | Indicates the 'Official' open value as determined by a Market Center. This transaction report will contain the market center generated opening price. |

ClosingPrints | Included | The transaction that constituted the trade-through was a single priced closing transaction by the Market Center. |

OpeningPrints | Included | The trade that constituted the trade-through was a single priced opening transaction by the Market Center. |

IntermarketSweep | Excluded | The transaction that constituted the trade-through was the execution of an order identified as an Intermarket Sweep Order. |

TradeThroughExempt | Excluded | Denotes whether or not a trade is exempt (Rule 611). |

OddLot | Excluded | Denotes the trade is an odd lot less than a 100 shares. |

QuoteConditionFlags | Description |

|---|---|

Closing | Indicates that this quote was the last quote for a security for that Participant. |

NewsDissemination | Denotes a regulatory trading halt when relevant news influencing the security is being disseminated. Trading is suspended until the primary market determines that an adequate publication or disclosure of information has occurred. |

NewsPending | Denotes a regulatory Trading Halt due to an expected news announcement, which may influence the security. An Opening Delay or Trading Halt may be continued once the news has been disseminated. |

TradingRangeIndication | Denotes the probable trading range (Bid and Offer prices, no sizes) of a security that is not Opening Delayed or Trading Halted. The Trading Range Indication is used prior to or after the opening of a security. |

OrderImbalance | Denotes a non-regulatory halt condition where there is a significant imbalance of buy or sell orders. |

Resume | Indicates that trading for a Participant is no longer suspended in a security that had been Opening Delayed or Trading Halted. |

QuoteConditionFlags | Description |

|---|---|

Regular | This condition is used for the majority of quotes to indicate a normal trading environment. |

Slow | This condition is used to indicate that the quote is a Slow Quote on both the bid and offer sides due to a Set Slow List that includes high price securities. |

Gap | While in this mode, auto-execution is not eligible, the quote is then considered manual and non-firm in the bid and offer, and either or both sides can be traded through as per Regulation NMS. |

OpeningQuote | This condition can be disseminated to indicate that this quote was the opening quote for a security for that Participant. |

FastTrading | For extremely active periods of short duration. While in this mode, the UTP Participant will enter quotations on a best efforts basis. |

Resume | Indicate that trading for a Participant is no longer suspended in a security which had been Opening Delayed or Trading Halted. |

In the preceding tables, Participant refers to the entities on page 19 of the Consolidated Tape System Multicast Output Binary Specification.

Suspicious Ticks

Tick price data is raw and unfiltered, so it can contain a lot of noise. If a tick is not tradable, we flag it as suspicious. This process makes the bars a more realistic representation of what you could execute in live trading. If you use tick data, avoid using suspicious ticks in your algorithms as informative data points. We recommend only using tick data if you understand the risks and are able to perform your own tick filtering. Ticks are flagged as suspicious in the following situations:

- The tick occurs below the best bid or above the best ask

- The tick occurs far from the current market price

- The tick occurs on a dark pool

- The tick is rolled back

- The tick is reported late

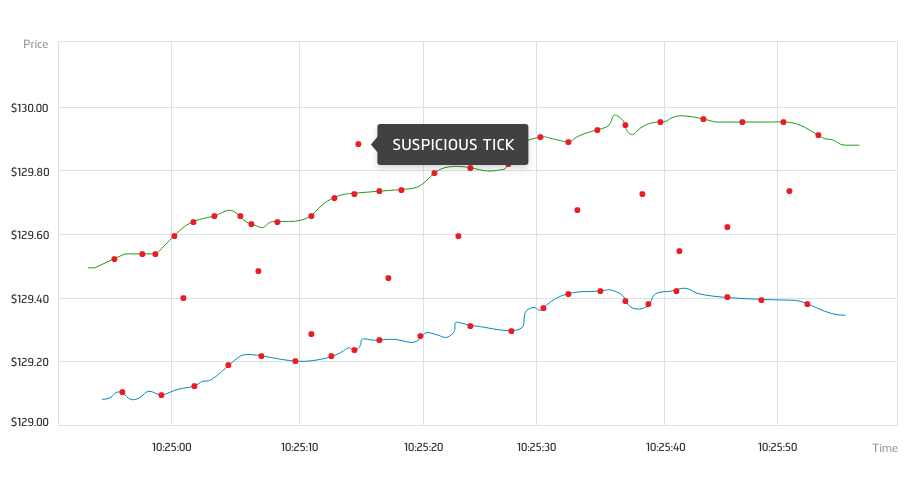

This image shows a tick that occurred above the best ask price of a security. The green line represents the best ask of the security, the blue line represents the best bid of the security, and the red dots represent trade ticks. The ticks between the best bid and ask occur from filling hidden orders. The tick that occurred above the best ask price is flagged as suspicious.

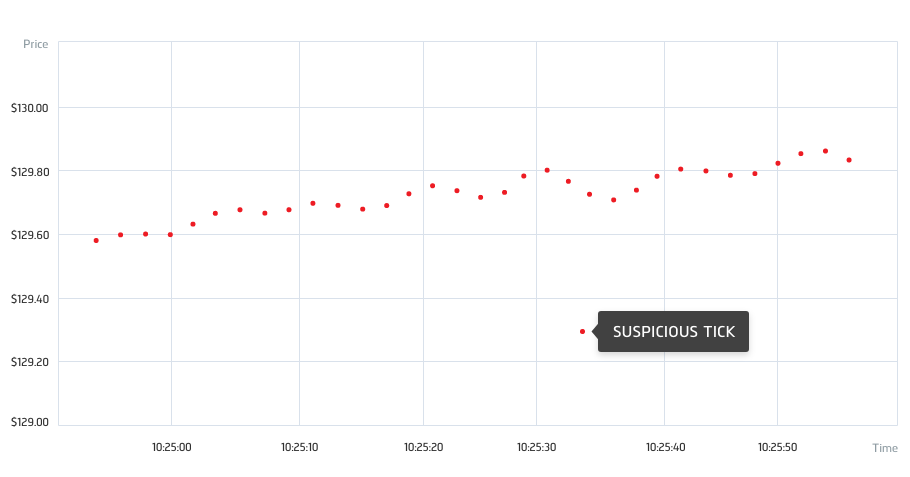

This image shows a tick that occurred far from the price of the security. The red dots represent trade ticks. The tick that occurred far from the market price is flagged as suspicious.

Delivery

Most live trading algorithms run on co-located servers racked in Equinix. Co-location reduces several factors that can interfere with your algorithm, including downtime from internet outages, equipment repairs, and natural disasters.

Live data takes time to travel from the source to your algorithm. The US Equities data feed has a latency of 20-50 milliseconds. QuantConnect is not designed for high-frequency trading.

Historical Data

When you request historical data or run warm-up, the amount of historical data you can access depends on the resolution of your data subscriptions. The following table shows the amount of trailing historical data you can access for each data resolution:

| Resolution | Available History |

|---|---|

| Daily | All historical data |

| Hour | All historical data |

| Minute | 1 year |

| Second | 2 months |

| Tick | 1 month |